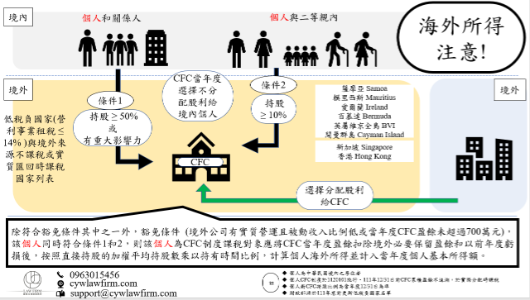

To avoid Control Foreign Companies (CFCs, or paper companies) paying lower tax for a dollar of money in so-called tax heaven countries (Taiwan Department of Finance updates the list and announce it in a regular basis) and withholding cash on the off-shore bank account, the government has amended the individual CFC law (In Income Tax Act). Starting from Jan. 1st, 2023, the CFC law takes effect.

In a single fiscal year, unless the passive income of the CFC is below a ratio or the earning is below a threshold, new CFC law mandates that the individuals who control the CFCs in a tax heaven prepare and file tax returns in that year, no matter the dividend of the CFCs is distributed or not. In other words, whether or not the CFCs distribute the earnings in this fiscal year to the ultimate owners of the CFCs, those earning since 2023 are taxable and the owners are obligated to file tax return to report the earnings.

CYW's clients are advised that the new law is not retrospective. The earning before 2023 is only taxable when dividend distribution takes place.

To discourage non-compliance, the progress of common reporting standard (CRS) in Taiwan has also been largely improved recently. Thus, it is always recommended to initiate self review and assessment to understand your options, the sooner the better.