Starting from 2023, the age of majority is eighteen-year-old. The Article 12 of Civil Law now rules that whenever you have reached eighteen year olds, you are legally eligible, for example, to marry someone.

In other words, a eighteen-year-old adult is able to make many decisions that are legitimate and legally binding.

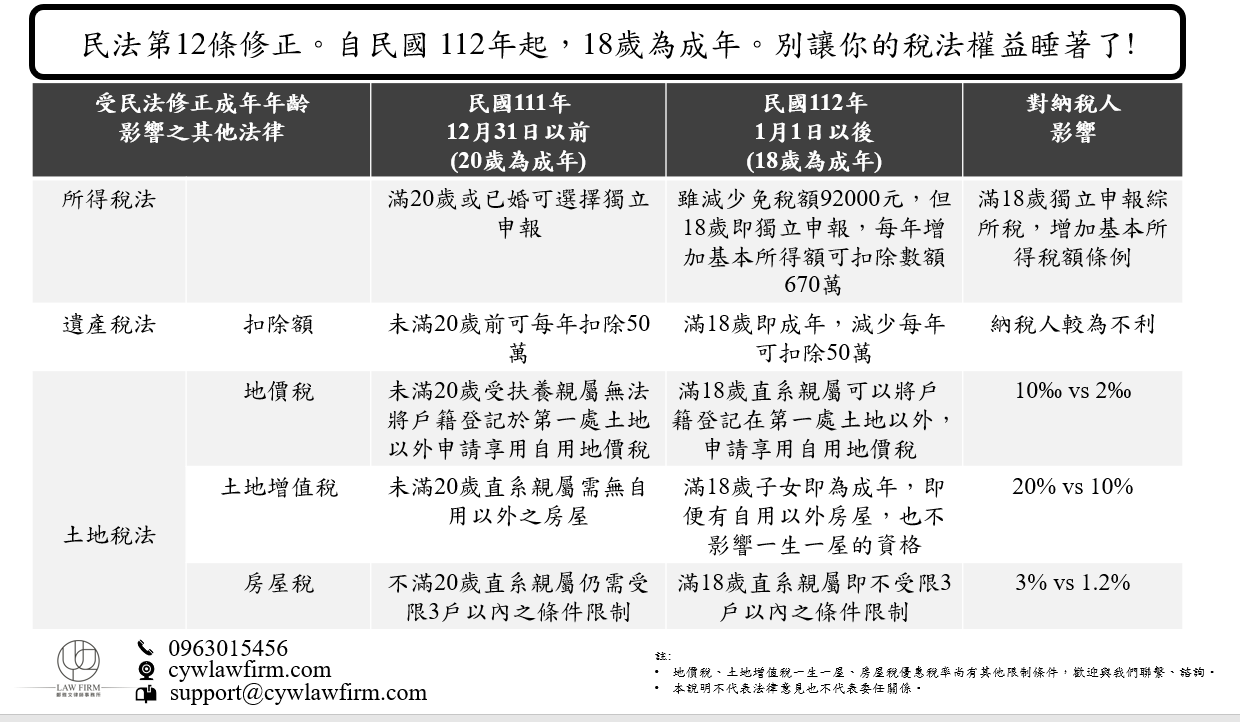

In tax world, the age of majority also plays a role. CYW law firm has summarized the impact of the legal adulthood, hoping to better position website users or clients with respect to the implementation of the new law.

For example, If you are eighteen years old, you are considered by Income tax law a independent tax return unit. That mean your parents are longer able to report exemption due to your independent tax status, but you have a quota of deduction up to 6.7 m NT$ in basic income tax law as an independent tax return unit.

How does that work for tax payers? If you and your parents have oversea income, and before 2023 you and your family, collectively as a single tax return unit, have paid extra income tax in the presence of the basic income tax, being an independent tax return unit since the start of 2023 means that the oversea income you and your family earn are assessed separately. Each of the unit has a deduction up to NT$ 6.7 million. Estate and Gift and Land Tax also apply the legal adulthood. Please be sure to approach CYW to understand the impacts.