The pandemic caused by the Corona virus has spread into many regions of the globe, and has put many people into serious conditions and taken away tens of thousands of lives.

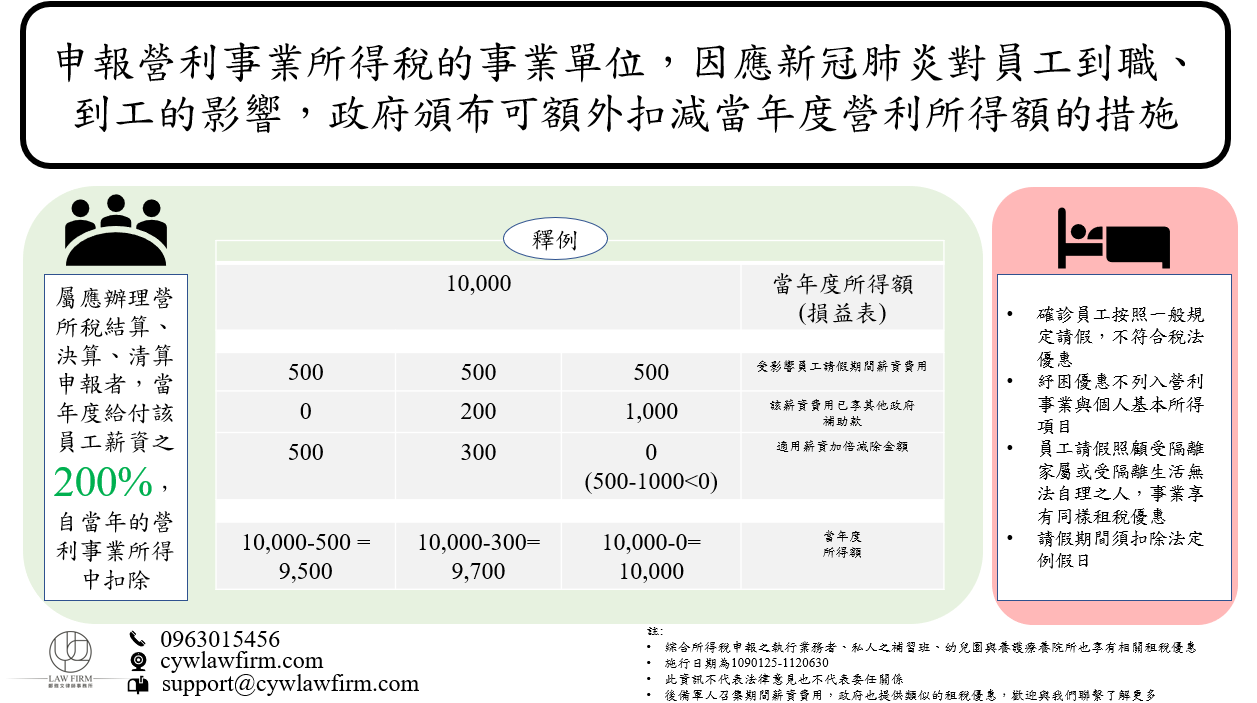

To help those affected business entity whose workforce are devastated, the government has granted business entity an extra amount of salary expense deduction. The tax benefit is effecitve until the mid of 2023.

Basically, if the workforce in your organization is isolated or put into quarantine but are not tested positive for Covid and therefore are not able to perform his/her work of duty for that period of time, the government allow double deduction for every dollar the business entity pay to that affected employee during the absence.

Again, the deduction cannot coexist with other tax benefits. CYW welcomes you to contact us to understand how the double expense works.