Resident vesus non resident

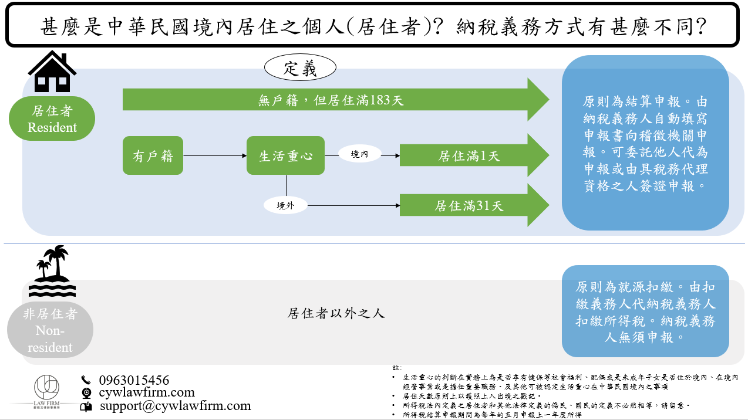

If an individual, not necessarily a citizen of Taiwan, stays in Taiwan for over 183 calendar days in a tax year, he or she is obligate to file the tax return, regardless the amount of the income source from Taiwan, as every Taiwanese citizen does in May of every year.

If you have registered your identifications in a household, namely you are a citizen, whether you are obligate to file the tax return depends on two considerations. The first is that you demonstrate you have something you attach to in Taiwan, like family member or businesses and the second is how long, as a citizen, you return and then stay in Taiwan.

The resident status also determines whether you have tax obligation concerning basic income tax.